If you dream of your financial legacy leaving a lasting impact on the world, there’s a way you can...

The Federal Reserve meets 8 times a year to discuss raising, lowering, or keeping interest rates the same. The...

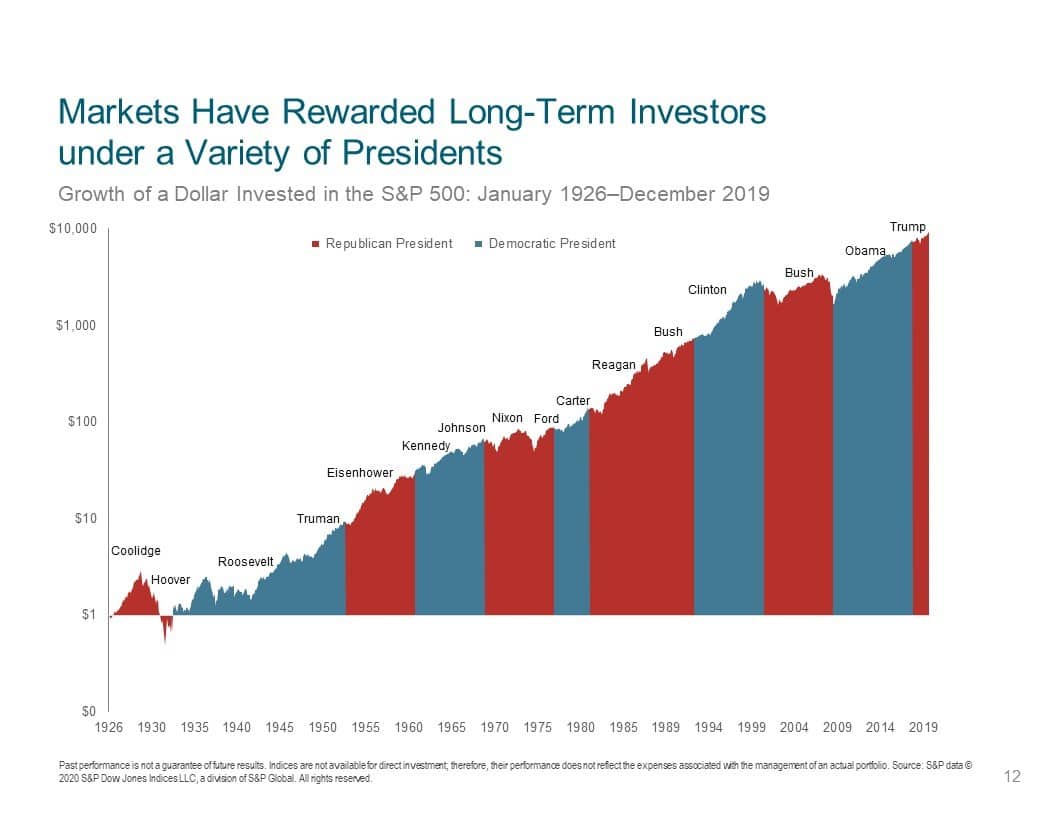

This week’s blog post is inspired by Mark, who asks, "How much stock should I hold in my portfolio...

60/40, fee-only financial planner, financial planning, investing, investment management, money, retirement, risk, stock market return

Ready to start the new year focusing on your financial well-being? Here’s a simple month-by-month list to get you...

There are many financial strategies to consider throughout the year with your financial advisor and tax accountant. By the...

After more than a year of interest rate hikes by the Federal Reserve, bond yields have risen to levels...

September 22nd was the last day of summer and the transition to fall is upon us. School is back...

Social Security recipients received an 8.7% increase in their benefit amounts in 2023, the largest increase since 1981. The...

In today’s fast-paced world, the need for quicker, more efficient payment methods has become increasingly essential. The Federal Reserve...

Banks are financial institutions that provide various services to individuals and businesses, such as checking and savings accounts, credit...

Even if you have never been subjected to an investment fraudster’s sales pitch, you probably know someone who has....

Divorce is a stressful time for everyone, but it can be particularly challenging for any person who may not...

So you’re thinking about giving a family member some money to help with a down payment on a home....

Early Environmental Social and Governance (ESG) InvestingTable of Contents1 Early Environmental Social and Governance (ESG) Investing2 Present Day ESG...

Health Savings Accounts (HSAs) are tax-advantaged medical savings plans, which can act like both a personal checking and investment...

Corporations bet on themselves by making strategic decisions that are aimed at increasing the company’s value over the long...

A topic we have been discussing in our meetings is the concept of year-over-year inflation. Near the middle of...

According to a survey by the Society of Actuaries, one of retirees’ biggest fears is investment losses. According to...

Given current market valuations and the pending interest rate movement, many investors are drawn to short-term investments. Fortunately for...

In 2022 the financial world will see multiple newsworthy stock splits. Earlier this year on June 6th Amazon split...

Cryptocurrency Has Become Too Big to IgnoreTable of Contents1 Cryptocurrency Has Become Too Big to Ignore2 What is Cryptocurrency?3...

What to Expect in the Future From the Federal Reserve? The Federal Reserve met this month for their second...

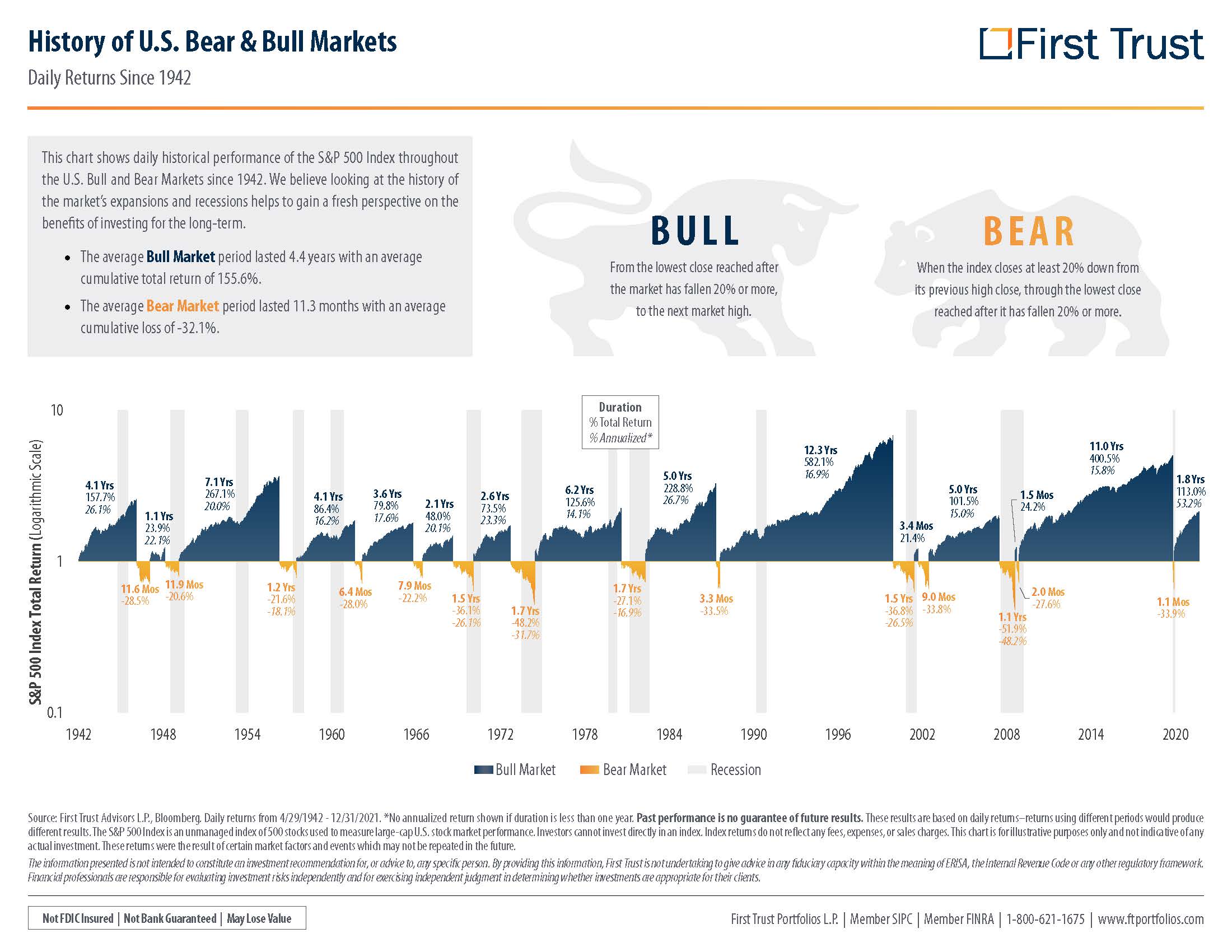

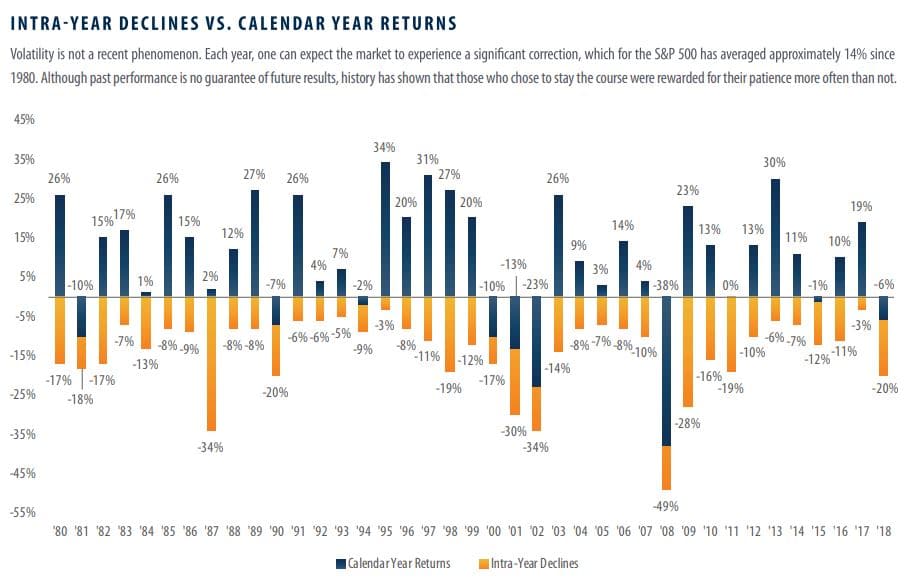

“Success seems to be largely a matter of hanging on, after others let go.” – William Feather Winners don’t...

financial planning, inflation, investment management, investment strategy, market timing, stocks, volatility

Economy & News, Financial Planning, Investing, Retirement Planning

Is the Bull market over? Are rising interest rates going to hurt bonds? Will inflation continue to rise? Why...

bear market, fee-only financial planner, investing, market timing, volatility

Economy & News, Financial Planning, Investing, Retirement Planning

No one ever sets out to invest money and have it end up as a loss, but over time,...

This blog is for couples: new couples, elderly couples, married couples, loving couples, divorcing couples, in all cases, partners as it relates to finance. Let’s start with...

How did one of golf’s biggest events create a unique tax break allowing you to rent your home tax-free?...

Record home sales have led to homeowners searching Zillow, trying to find the perfect place to move. For some,...

Work with me on this analogy. There are many pieces to a puzzle. Imagine that the puzzle you are...

Currently, there are very few places to grow one’s money better than investing in the stock market. And many...

Pandemic Relief ActsTable of Contents1 Pandemic Relief Acts2 The American Rescue Plan2.1 Benefits of the Plan2.1.1 Stimulus Checks2.1.2 Unemployment...

We have talked a lot about financial wellbeing in our past blogs and how not to let our emotions...

fee-only advisor, fee-only financial planner, financial planning, investing, investment management, safe money, stocks

Proposition 19 recently passed in California, the results of which could mean property tax breaks for those over 55...

With the election just days away and COVID-19 cases still surging globally, you may feel the unrest that goes...

The stage is set…it is Trump/Pence vs Biden/Harris. And just in case 2020 has not been eventful enough, let’s...

The title of today’s blog is in thanks to the many great sayings of Yogi Berra. Major League Baseball...

I am a first-time parent to a now 9-month-old daughter. It has been an incredible experience, and for the...

You may think that if you want to increase your financial well-being, the time spent on financial data, like...

With the second wave of COVID-19 either looming or upon us, you might be feeling the added stress that...

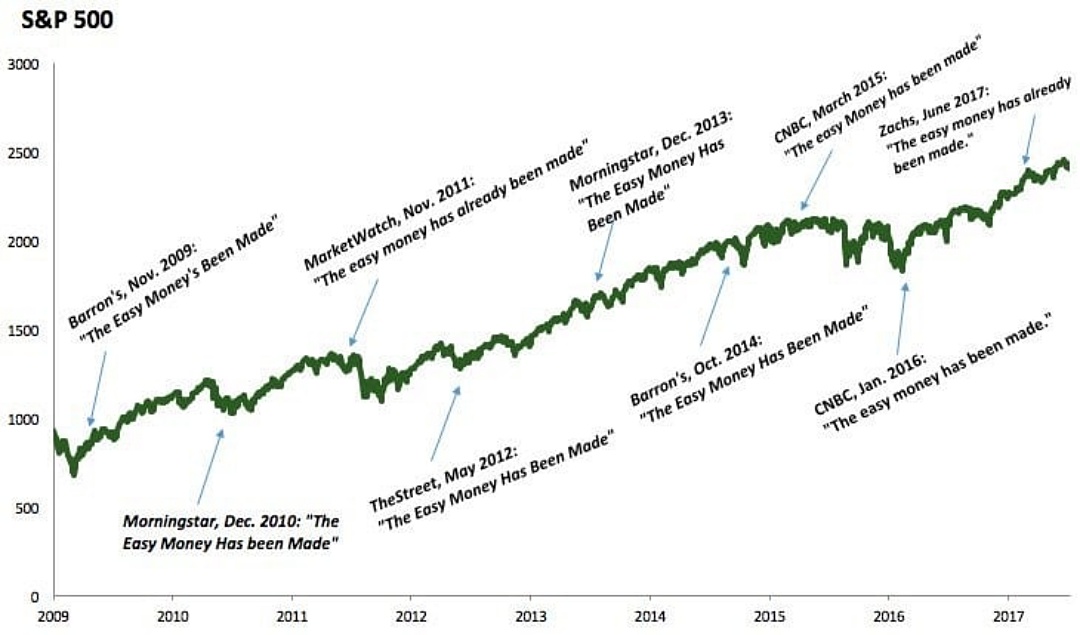

“The easy money has been made.” If you follow CNBC, Barron’s, or other major financial news outlets, you may...

Wellness and the B-Word: Where to begin your financial wellness journey. Wellness seems to be an all-encompassing buzz word...

Show Me The Money: Two Rules For Your Retirement Nest Egg There are two rules that we talk about...

Although the CARES Act’s $2 trillion allocation to the economy has been compared to President Obama’s 2009 American Recovery...

CARES Act, Coronavirus, Covid-19, FICA, FSA, Health Savings Account, HSA, Investment, investment retirement account, IRA, Recovery and Reinvestment Act, Required Minimum Distribution, RMD, social security, taxes

Financial Planning, Investing, Retirement Planning, Tax Planning

Are you dreaming of retirement, or currently in retirement and dreaming of a new chapter in life? Once a...

Do You Want to Gamble with Your Nest Egg? If you ever visit Las Vegas, you may hear the...

The “Setting Every Community Up for Retirement Enhancement” (SECURE) Act passed the U.S. House of Representatives last May, passed...

Free Advice is Worth Every Penny. A weathered sign hangs in our local mechanic’s garage: We offer three kinds...

Investors have a fascination with predictions. Look at the financial media. Turn on any television show, listen to any...

Similar to today, the Roaring 1920s saw rapid technological change with cars and electricity. This created a farm surplus...

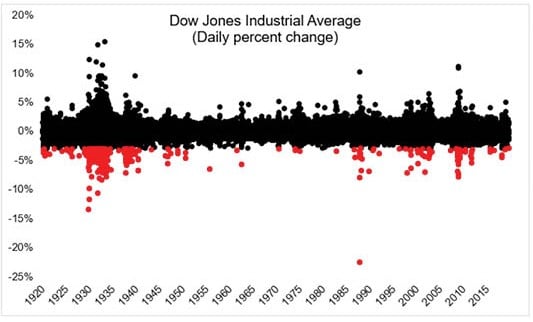

This week marked the 307th time that the Dow Jones index fell 3% or more in a single day...

Retirement planning can start in any decade of your life. In Chapter 2 of the book, Your Insiders’ Guide...

Creating a financial plan not only gives you a road map to your retirement goals, but it also allows...

Experts say that healthcare alone could cost the average couple hundreds of thousands of dollars during their retirement. That...

Retirement is changing. There is a shift taking place on how we retire and who can help us get...

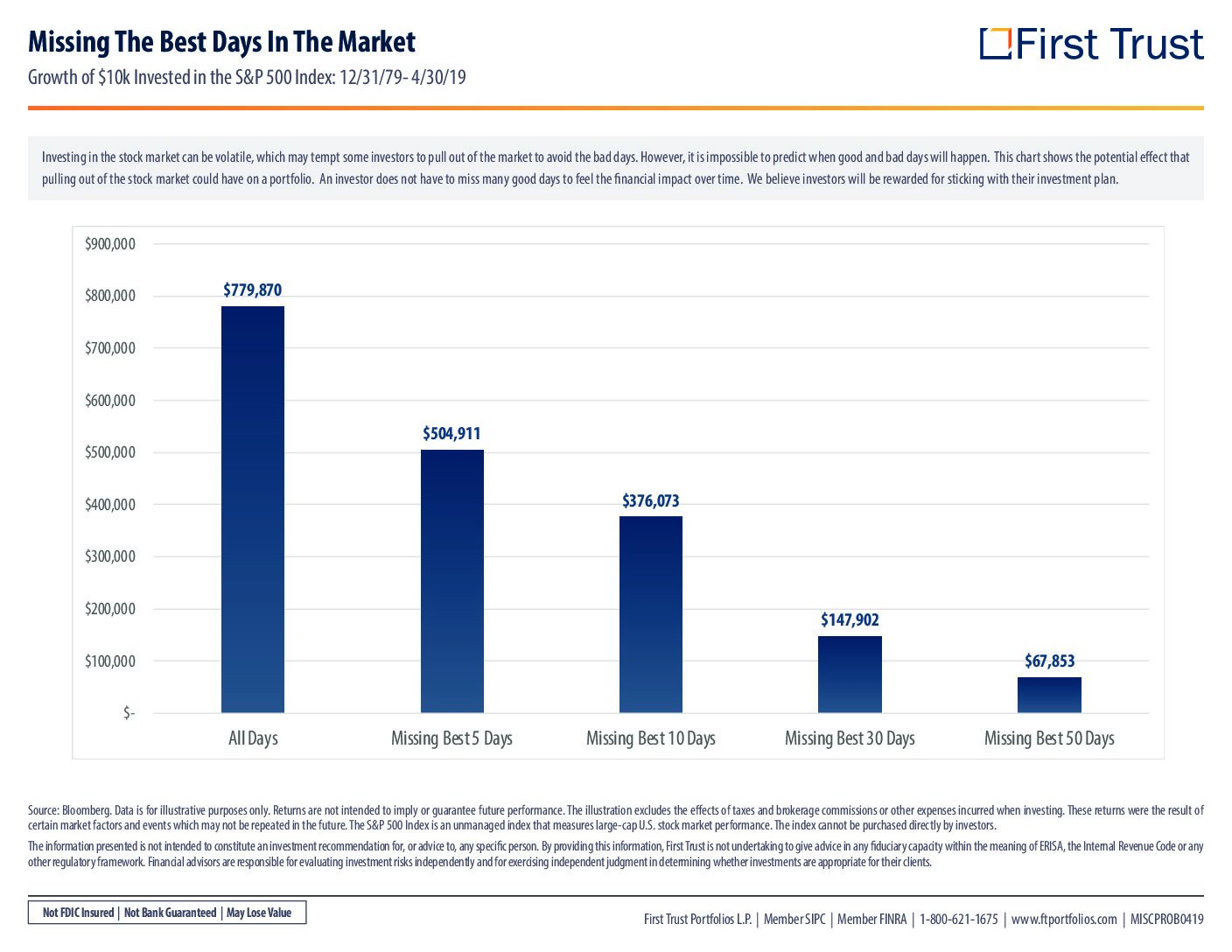

Staying the Course Investors tend to see short-term volatility as the enemy. Volatility may lead many investors to move...

fee-only financial planner, financial planning, investing, investment management, market, market timing, risk, safe money, stocks

The last two months have brought continued market volatility to both stocks and bonds. It can be hard to...

fee-only advisor, financial planning, great life, Individual Retirement Account, interest, market, retirement, stocks, volatility

Over the weekend, a relative asked, “Are we in a bear market?” I answered his question with, “What do...

Job numbers were released earlier this month, and it was another month, 92 consecutive months to be exact, of...

Did that headline get your attention? There are hundreds of distractions around us every minute of the day. It...

You’ve seen the headlines, you’ve heard the talking heads, you likely have negative feelings when you see the term...

Many people are ready to make the transition to retirement. They envision living a less stressful, carefree lifestyle. Where...

alternative investments, budget, employer benefits, Estate Planning, fee-only financial planner, financial planning, great life, Individual Retirement Account, investing, investment management, life insurance, real estate, retirement, Vacation

How much can retirees withdraw from their nest egg each year? This is a question that many thought was...

budget, employer benefits, fee-only financial planner, financial planning, great life, Individual Retirement Account, insurance, investing, investment management, IRS, life insurance, living, long-term care, markets, money, pension, principal, purchasing power, retirement, safe money, shopping, total return, Trust

Whether you’re already retired or thinking about retiring within the next few years, a second act might be on...

employer benefits, Estate Planning, fee-only financial planner, financial planning, great life, Individual Retirement Account, insurance, interest, investing, investment management, long-term care, long-term disability, money, purchasing power, Qualified Retirement Plan, retirement, risk, safe money, spending, taxes

U.S. stocks are cresting to all-time highs, almost daily. These are the times when investors look forward to opening...

alternative investments, budget, capital gain, dividend, fee-only financial planner, financial planning, Individual Retirement Account, investing, investment management, market, money, purchasing power, statements, stocks, taxes

Applying for financial aid for college is becoming less stressful after President Obama changed the earliest FAFSA filing date...

academic year, Applying, College, Deadline, Fafsa, financial planning, High School, IRS, Prior prior rule, Student Aid, tax information, tax return, taxes

Identity theft is on the rise. The most recent statistics (2014), according to the Bureau of Justice Statistics, an...

aware, bank, coverage, credit, credit cards, databanks, dispute, equifax, Expenses, experian, identity theftt, information, money, monitoring, passwords, personal, prevention, private, protect, report, restoration, review, risk, safe money, shopping, shredder, social security, spending, stealing, transunion, travel

It sure seems like we’ve had our fair share of investment volatility of this century. There have been two...

budget, financial planning, great life, Individual Retirement Account, insurance, money, shopping, spending, volatility

Inflation since 2008 has been very low. The average since 2008 is a paltry 1.48%. The numbers annually are...

budget, financial planning, great life, Individual Retirement Account, inflation, interest, investing, investment management, money, risk, safe money, spending

Not if, but when. Bear Markets are part of investing in the stock market. This is a fact, you...

bear market, bull market, fee-only advisor, fee-only financial planner, financial planning, investing, market timing, Money Market, stock return, volatility

One of the greatest worry’s for anyone who is retired, is running out of money. Of course, if we...

bank, budget, employer benefits, Expenses, Golden, Holidays, investing, investment management, Life, money, Plan, retirement, safe money, spending, Years

Many people have heard about reverse mortgages. They are hyped on TV, radio, magazines and many brokers recommend them...

Perhaps the single most important factor in reducing financial stress is managing cash flow. In their book The Millionaire...

budget, Couples, Expenses, Finance, Financial Goals, financial planning, Funds, great life, Marriage, Saving, shopping, spending, Vacation

Is the Bull market over? Are rising interest rates going to hurt bonds? What about the volatility in the...

bear market, bull market, diversified portfolio, fee-only advisor, fee-only financial planner, investing, investment management, investment strategy, market timing

Many employers provide or share the cost of health insurance, for their employees. This is a wonderful benefit. Since...

Last blog we shared some ideas about how boomers may be able to retire on less money than many...

financial planning, Individual Retirement Account, money, Qualified Retirement Plan, real estate, rental property, retirement, safe money

Much has been written about the inadequate level of saving by Baby Boomers in America. Not a day goes...

employer benefits, investing, investment management, life insurance, living, long-term care, money, Qualified Retirement Plan, retirement

One of the most challenging aspects of investing is evaluating investment performance. There is a never ending cornucopia of...

However, while tax-deferred growth can be a good deal, paying taxes on the way out may be a bad...

employer benefits, financial planning, Individual Retirement Account, Qualified Retirement Plan, retirement, taxes

Oil is on sale! With such low prices, our client Marcus Junius Brutus the Younger has decided that now...

Many company officers and other highly-compensated executives receive a whole host of employer retirement benefits, including not only a...

employer benefits, financial planning, investing, money, pension, Qualified Retirement Plan, retirement, risk, taxes

Today’s post is inspired by Charlemagne, who writes in to ask about a sudden drop in value of one...

To iron out his retirement plan, Temüjin meets with a financial advisor. Temüjin’s plan is ambitious, with a travel...

fee-only financial planner, financial planning, insurance, investing, investment management, life insurance, money, Qualified Retirement Plan

With financial planning, not only do you map out your dreams. Even better, you create a plan for making...

Meet Marcus. Marcus has poured tens of thousands of dollars into his whole life insurance policy. He's sick of...

fee-only financial planner, financial planning, insurance, investing, investment management, life insurance, money, permanent life insurance, retirement, risk, safe money, taxes, term life

A client expresses concern over his growing debt. The fact that the wealthy individual even has debt is puzzling....

alternative investments, budget, fee-only financial planner, financial planning, Individual Retirement Account, investing, investment management, liquidity, money, Qualified Retirement Plan, real estate, rental property

Can I interest you in a car that has a built-in dishwasher? It’s just like a regular car, but...

fee-only financial planner, financial planning, Individual Retirement Account, insurance, investing, investment management, liquidity, money, Qualified Retirement Plan, retirement, taxes

Considering how much risk (a lot) is required for a given return (a little), there may be better investment...

alternative investments, capital gain, fee-only financial planner, financial planning, investing, investment management, money, retirement, risk, robo-advisor, taxes

Imagine wandering around your favorite department store. There is a massive sale – with many products being sold below...

behavioral finance, fee-only financial planner, financial planning, investing, investment management, money, safe money

Phil writes in to say, "Why isn’t my portfolio of stocks, bonds and alternative investments matching the performance of...

alternative investments, fee-only financial planner, financial planning, investing, investment management, money, real estate

In a previous post, we discussed three distribution options available to pensioners. That is, how will you receive the...

employer benefits, fee-only financial planner, financial planning, investing, investment management, money, pension, retirement, risk, safe money

You want to know how much money your investment is generating, right? This knowledge can help you determine if...

In the fiduciary model, the financial advisor is legally obligated to act in the client’s best interest. This legal...

You may already be invested in private equity; large pension plans are very keen on private equity investments. If...

alternative investments, employer benefits, fee-only financial planner, financial planning, investing, investment management, money, pension, private equity, Qualified Retirement Plan, real estate

Our opinion that fee-only financial planning is terrific is biased. So, you do not have to take our word...

For shorter investment timelines, the safety of your money may be more important than the fact that the money...

bonds, Certificates of Deposit, FDIC, fee-only financial planner, inflation, interest, investing, liquidity, money, Money Market, principal, purchasing power, safe money, stocks

Question #3: "Are you healthy?" If not, then it becomes much more difficult to qualify for a long-term care...

Beneficiaries, Estate Planning, fee-only financial planner, financial planning, health, insurance, long-term care, Medi-Cal, Medicaid, Medicare, money

"You want to be confident that they will still be in business when, and if, you need to file...

benefit period, employer benefits, fee-only financial planner, financial planning, insurance, long-term disability

A stretch IRA is not a type of IRA account. Rather, a stretch IRA is a distribution strategy for...

Beneficiaries, Estate Planning, fee-only financial planner, financial planning, Individual Retirement Account, inherited IRA, investing, money, stretch IRA, taxes, Trust

The Social Security Administrations reports: ...over 1 in 4 of today’s 20 year-olds will become disabled before reaching age 67. Those...

elimination period, employer benefits, financial planning, insurance, long-term disability, money, purchasing power

If you’re one of the few lucky Americans that has a pension, you may have a deliberation in front...

employer benefits, fee-only financial planner, financial planning, Individual Retirement Account, money, pension, Qualified Retirement Plan

In addition to eternal happiness, marriage provides countless financial advantages, including: Possible Tax Reduction The ability to contribute to...

Beneficiaries, Estate Planning, financial planning, Individual Retirement Account, Qualified Retirement Plan, retirement

Life’s emotional challenges are often intertwined with life’s financial challenges. When it comes to advanced financial planning, these life...

bank, Beneficiaries, Estate Planning, financial planning, Individual Retirement Account, money, Qualified Retirement Plan, Trust, Will

It is important to understand your cash flow; you want to know where your money is going. For the...

Table of Contents1 1.1 Short-Term Capital Gains1.2 Long-Term Capital Gains1.3 Interest Income1.4 Ordinary Cash Dividends1.5 Qualified Dividends Different types...

Enjoying retirement requires following just two simple rules. This sounds too easy – one would imagine that a successful...

You have seen the commercials: people carrying their nest eggs, or their money board, indicating the hypothetical dollar amount...