Retirement Planning For Your Financial Freedom

We are a fiduciary financial advisor team that helps you create a comprehensive financial plan and investment strategy for a meaningful and secure retirement

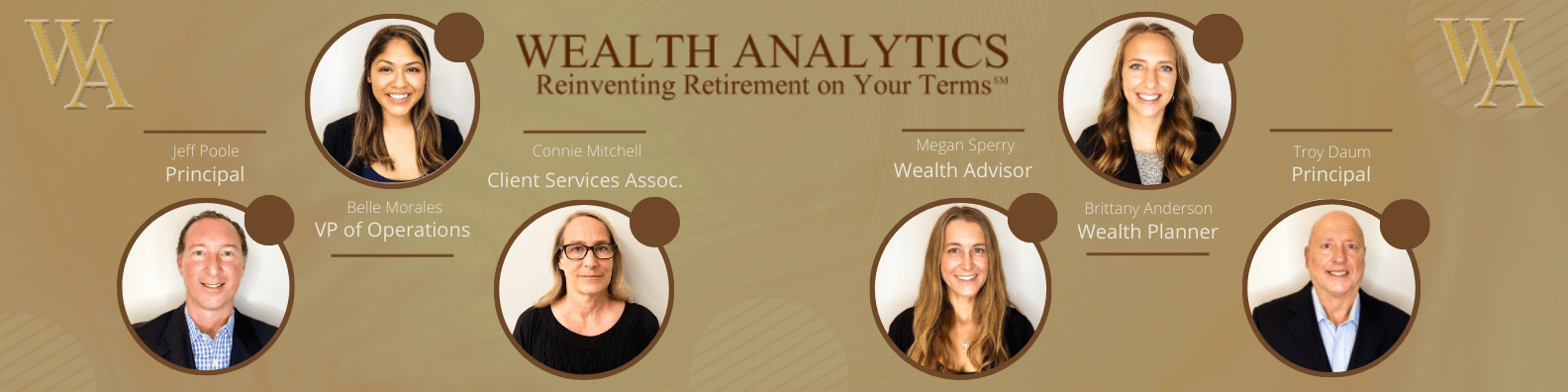

Retirement Planning from Wealth Analytics

IF RETIREMENT IS A JOURNEY,

Where Are You?

Ready for a fresh start or a second opinion on your money – let’s talk!

Preparing for retirement is not automatic.

You need an experienced advisor who specializes in your exact situation, with systems in place to make your plan work.

Start HereDON’T LET ANOTHER DAY GO BY.

It's your life. It's your story.

It's your time.

It’s your time to be financially independent. It’s your time to live the life you’ve worked for. It’s your time to do the things you’ve always wanted to do. Financial planning with Wealth Analytics will help you get there.

Ready for a fresh start or a second opinion on your money - let's talk!

Start Here