Creating a financial plan not only gives you a road map to your retirement goals, but it also allows you to better understand the emotional elements of the stock market. Why do very smart people make bad decisions about their money?

The answer is found in the brain. A company called Dalbar has been studying investor returns since 1984. They measure the effects of investor decisions and choices. They report their findings each year, and the results are consistently startling. The results year after year show that the average investor earns less than mutual fund performance reports would suggest. In other words, if a mutual fund had an average return of 10%, investors normally earned below 5%.

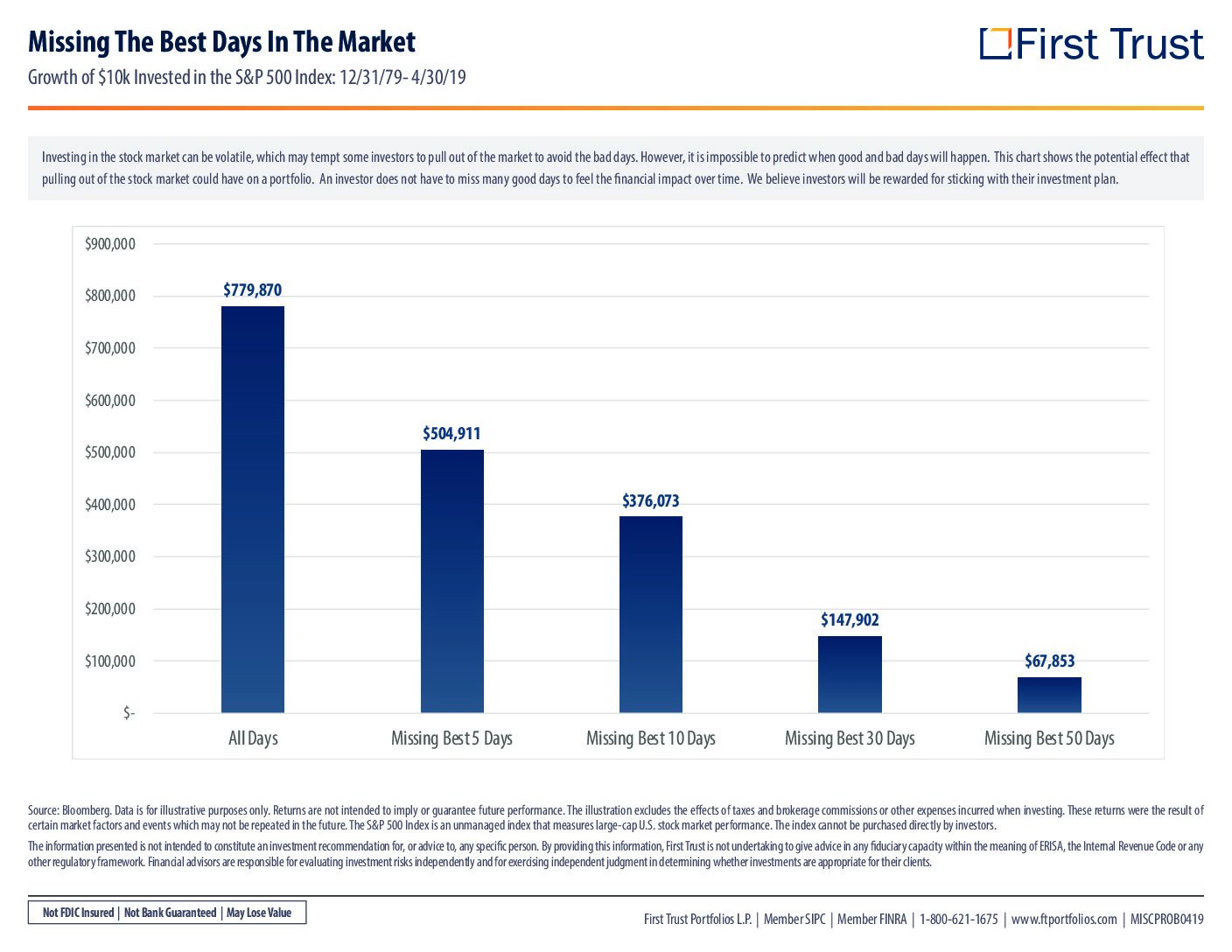

The Dalbar studies show people indeed are detrimental to their financial plans. See the attached bar chart showing returns over 40 years, and what the impact of missing the best days in the markets does to your money. An investors emotion to try and sell in bad times, and then miss the upswing of the big recovery compounds on itself. By missing out on those big up days, you lose out on that money compounding and growing over many years to come. It does more harm than staying the course and be prepared for market downturns.

Investors don’t intend to harm themselves, but they do, consistently. Having a financial mentor and a guide to help navigate you through these ups and downs of the markets will be one of the best decisions you’ve ever made.