Staying the Course

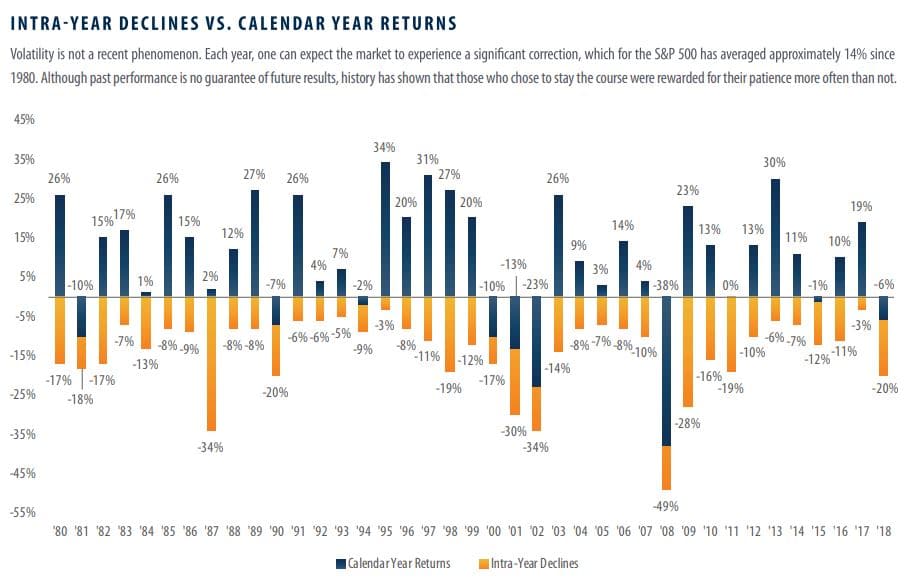

Investors tend to see short-term volatility as the enemy. Volatility may lead many investors to move money out of the market and “sit on the sidelines” until things “calm down.” Although this approach may appear to solve one problem, it creates several others:

- When do you get back in? You must make two correct decisions back-to-back; when to get out and when to get back in.

- By going to the sideline, you may be missing a potential rebound. This is not historically unprecedented; see chart.

- By going to cash, you could be not only be missing a potential rebound but all the potential growth on that money going forward.

The wiser course of action may be to review your plan with your advisor and from there, decide if any action is indeed necessary. This placates the natural desire to “do something,” but helps keep emotions in check.

Source: First Trust Advisors, Bloomberg, as of 12/31/18.