Staying the Course Investors tend to see short-term volatility as the enemy. Volatility may lead many investors to move money out of the market and “sit on the sidelines” until things “calm down.” Although this approach may appear to...

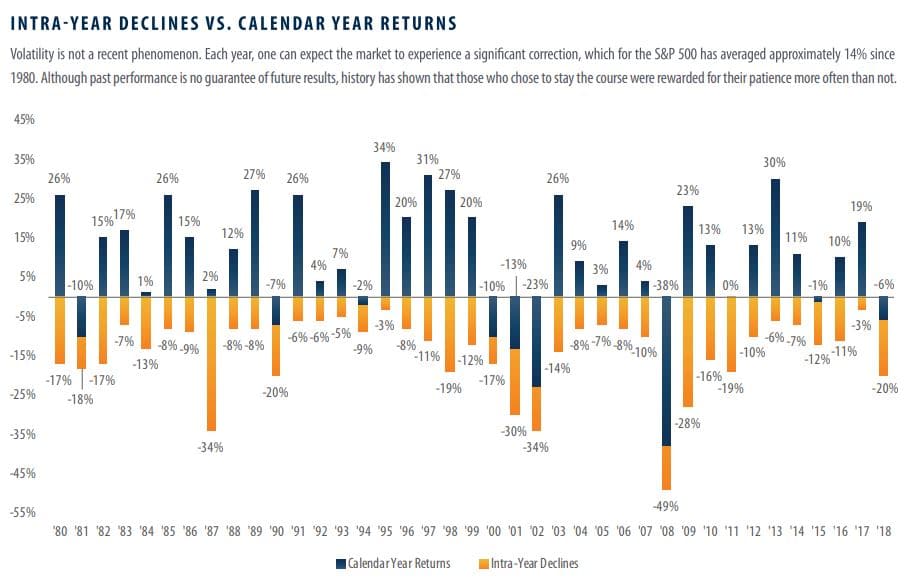

The last two months have brought continued market volatility to both stocks and bonds. It can be hard to stomach at times, yet it’s also expected. The long-term investor knows that markets on average, go up 7 out of...

U.S. stocks are cresting to all-time highs, almost daily. These are the times when investors look forward to opening their monthly statement. The anticipation is high, you open the envelope (or electronic statement) and wow, is that right? Shouldn’t...

Many people have heard about reverse mortgages. They are hyped on TV, radio, magazines and many brokers recommend them aggressively. As a financial planners we have considered them as a possible solution for those who are concerned about outliving...