This week’s blog post is inspired by Mark, who asks, "How much stock should I hold in my portfolio to get an investment return of 30% a year?" The answer isn't what you think it may be, because investment...

So you’re thinking about giving a family member some money to help with a down payment on a home. Or maybe you want to help contribute to a college fund for your grandkids. But you have heard about a...

Health Savings Accounts (HSAs) are tax-advantaged medical savings plans, which can act like both a personal checking and investment account for medical expenses now or in the future. The changes for 2023 increased HSA contribution limits by $200 for...

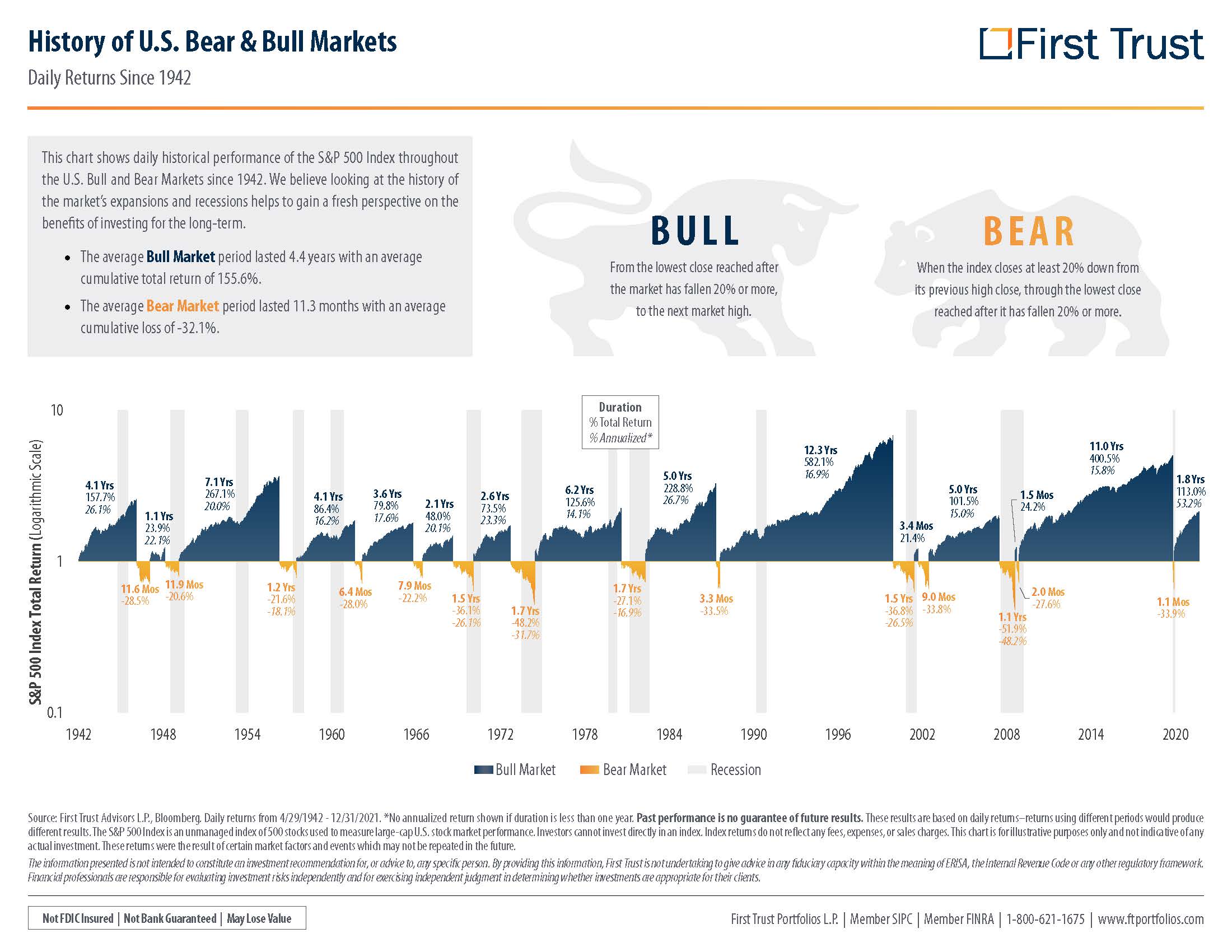

“Success seems to be largely a matter of hanging on, after others let go.” – William Feather Winners don’t quit the stock market. Period. Investors always win over the long term. It’s quite easy to see in the chart,...

No one ever sets out to invest money and have it end up as a loss, but over time, most investors will end up with some winners and some losers. A strategy called tax-loss harvesting is a way to...

We have talked a lot about financial wellbeing in our past blogs and how not to let our emotions derail our financial plan, yet FOMO (fear of missing out) is trending now and deserves our attention. Did someone ever...

Proposition 19 recently passed in California, the results of which could mean property tax breaks for those over 55 in the state and potential tax increases for those inheriting homes from their parents or grandparents. For those homeowners thinking...

Are you dreaming of retirement, or currently in retirement and dreaming of a new chapter in life? Once a year everyone should take the time to review and update their financial plan. In addition to your financial needs, it’s...

Retirement planning can start in any decade of your life. In Chapter 2 of the book, Your Insiders’ Guide To Retirement, we say you must have a plan. Setting a goal is not the main thing. It is deciding...

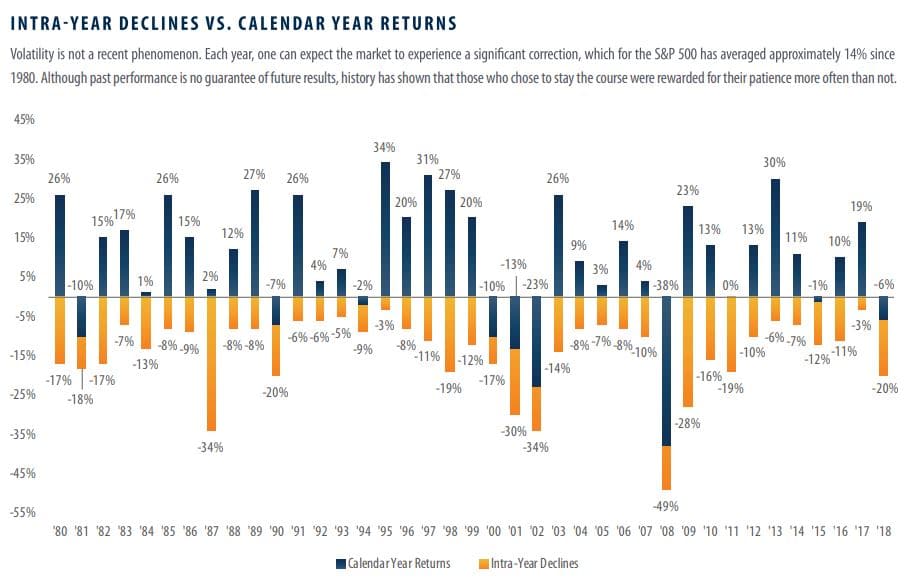

Staying the Course Investors tend to see short-term volatility as the enemy. Volatility may lead many investors to move money out of the market and “sit on the sidelines” until things “calm down.” Although this approach may appear to...