This week’s blog post is inspired by Mark, who asks, "How much stock should I hold in my portfolio to get an investment return of 30% a year?" The answer isn't what you think it may be, because investment...

Is the Bull market over? Are rising interest rates going to hurt bonds? Will inflation continue to rise? Why is the market so volatile? Many people are worrying. Maybe you are one of them and ask the same questions....

This blog is for couples: new couples, elderly couples, married couples, loving couples, divorcing couples, in all cases, partners as it relates to finance. Let’s start with the (unfortunate) fact. There is something inevitable in any relationship. The end. Relationships, as we know them, come to an end....

We have talked a lot about financial wellbeing in our past blogs and how not to let our emotions derail our financial plan, yet FOMO (fear of missing out) is trending now and deserves our attention. Did someone ever...

Free Advice is Worth Every Penny. A weathered sign hangs in our local mechanic’s garage: We offer three kinds of service – GOOD, CHEAP, FAST. You can pick any two: GOOD service CHEAP won’t be FAST GOOD service FAST...

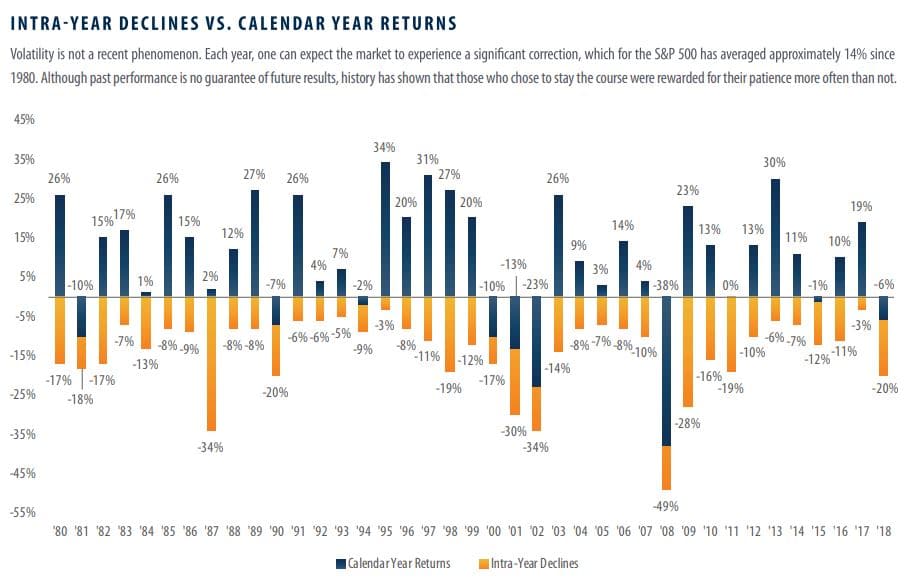

Staying the Course Investors tend to see short-term volatility as the enemy. Volatility may lead many investors to move money out of the market and “sit on the sidelines” until things “calm down.” Although this approach may appear to...

Many people are ready to make the transition to retirement. They envision living a less stressful, carefree lifestyle. Where they can be adventurers, live next to the ocean, hear the waves crash. Enjoy the warm sunshine, swim in the...

How much can retirees withdraw from their nest egg each year? This is a question that many thought was answered by the 4% rule, first articulated by Bill Bengan in 1994. Bengan is a retired financial planner from Southern...

Whether you’re already retired or thinking about retiring within the next few years, a second act might be on your mind. Have you given thought to what you’ll spend your time on in retirement? Many older adults view retirement...

U.S. stocks are cresting to all-time highs, almost daily. These are the times when investors look forward to opening their monthly statement. The anticipation is high, you open the envelope (or electronic statement) and wow, is that right? Shouldn’t...