Recently, Marcus Tullius Cicero asked us to take a look at his assets. In addition to the traditional portfolio of stocks, bonds (and Italian real estate), Cicero has a variable whole life insurance policy.

What is Variable Whole Life Insurance?

Table of Contents

- 1 What is Variable Whole Life Insurance?

- 2 Should I Keep My Variable Whole Life Insurance Policy?

- 3 Getting out of Your Whole Life, Variable Life, or Universal Indexed Life Insurance Policy

- 4 Buy Term & Invest the Difference

- 5 What about the Cash Surrender Value of my Variable Whole Life Insurance Policy?

- 6 What are the Tax Consequences of my Variable Whole Life Policy?

Variable whole life insurance is a type of life insurance, but a complex type of life insurance. Variable whole life is complicated because it is not just life insurance, but a combination of a death benefit, and a cash savings component.

Cicero’s circumstance is not unique; many working professionals find themselves owning an expensive variable whole life insurance policy (or a similar indexed universal life insurance policy). Usually, these variable whole life insurance policies get sold because of aggressive sales techniques of company insurance agents; the agents pushing the policies offer all sorts of magical promises:

-

-

- High Return

- Low Risk

- Tax-Deferred Growth

- Tax-Free Distributions

- Tax-Free Death Benefit

-

Unfortunately, if it’s too good to be true, then it’s too good to be true. Instead of fee-ridden variable whole life insurance, we most often recommend simple, inexpensive term life insurance to our financial planning clients. This is because variable whole life is rarely appropriate.

BUT, what if the client walks through the door already owning a variable whole life insurance policy – as Cicero recently did? Should they get out of it? If so, how?

Should I Keep My Variable Whole Life Insurance Policy?

Since he already bought the variable whole life insurance policy, should Cicero keep it in place? The answer is, “it depends.” Firstly, let’s examine the ancient Roman lawyer’s particular needs:

- Does Cicero still have a need for life insurance?

- If so, does he qualify for a more favorably-priced (read: inexpensive) term-life insurance policy?

If the answer to the first question is “Yes” (i.e. Cicero needs life insurance), and the answer to the second question is “No” (Cicero is not eligible for a term life policy at a competitive rate), then it may be appropriate to consider maintaining the existing variable whole life insurance policy. To break it down, consider that:

-

-

- Cicero must have life insurance (because of his dangerous political career), and

- A term policy is not an option.

- Therefore, a permanent life insurance policy (such as a whole life, variable life, indexed universal life, etc.) may get the job done.

-

Getting out of Your Whole Life, Variable Life, or Universal Indexed Life Insurance Policy

However, if the answer to the first question is “No” (i.e. Cicero does not need life insurance), or if the answer to the second question is “Yes” (i.e. Cicero does qualify for an inexpensive term-life policy), then the solution is:

Cicero should get out of the variable whole life insurance policy.

If Cicero does require life insurance and still qualifies for affordable term life insurance, the solution is simple:

Cicero should purchase a term-life insurance policy.

Using a term life policy instead of Cicero’s variable whole policy will save him a tidy sum of money each month. This “tidy sum” can be spent at his discretion.

Buy Term & Invest the Difference

With a permanent life insurance policy (such as the Cicero’s variable whole life policy, or similar indexed universal life policies), money regularly goes into a savings component. Given this, it may be appropriate for Cicero to ditch his variable whole life policy and put the money he saves into an investment account.

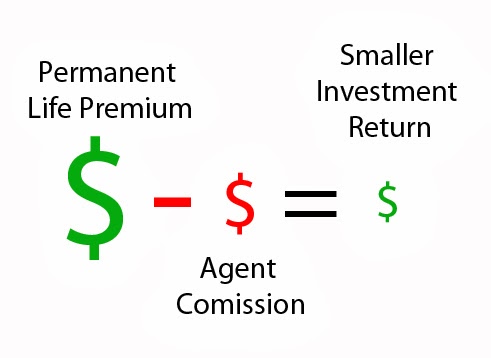

If Cicero does decide to invest his money, he can do so by using low-cost investment products. Low-cost investing is quite distinct from investing with a permanent life insurance. This is because of the multitude of high fees involved with policies like variable whole life. Without a very expensive middle man (i.e. insurance company), investing using low-cost products can ultimately give Cicero a higher rate of return on his money.

What about the Cash Surrender Value of my Variable Whole Life Insurance Policy?

Ongoing life insurance aside, what about the cash surrender value on the existing variable whole life policy? Cicero has owned his variable whole life policy for years. Over time (and via expensive premium payments), the savings component of the variable whole life insurance policy has grown into a sizeable amount: in excess of $40,000. This begs the question:

With such a large cash value at stake, does Cicero simply cease payments on his variable whole life insurance policy?

Does it make sense to lose the built-up cash value in a variable whole life insurance policy simply to avoid putting more money into the high premiums each month? To answer the question, let’s look at the numbers.

The growth in cash value of the variable whole life policy relative to the premiums usually makes a strong case for ceasing payment. That is, when you figure out how much cash value is built up when considering how much money is going in, judgment dictates “stop putting in money!”

Looking at the statements of Cicero’s variable whole life insurance policy, we note that for every dollar put into the policy nets less than one dollar in cash value.

Because of the myriad fees and expenses embedded into this variable whole life insurance policy, Cicero’s cash value was actually beginning to wane! However, the above formula is a bit unfair because we must also account for the value of the insurance itself: the death benefit. (However, if Cicero does not need life insurance for any reason – i.e. Cicero has no dependents, etc. – than it can be difficult to justify this “tax” on the contributions.)

However, even when including for the cost of a comparable term life policy, each dollar invested still gets taxed by the insurance company. (We measured this by shopping for a term policy, comparing the sum of the term premium and the increase (or loss) in cash value of the whole life policy, to whole life premium.) When we looked at Cicero’s variable whole life insurance policy; we found this his variable whole life policy was no exception: paying into his variable whole life policy was not a good deal – because of all the fees charged by a middle man.

The value of maintaining a variable whole life policy should be considered in the vacuum of the growth in cash value relative to premium payments; a final point of consideration is Cicero’s taxes. If surrendering the policy for its cash value, the famous orator may be looking at a tax bill.

What are the Tax Consequences of my Variable Whole Life Policy?

We determined just how much of the surrender value is taxable by examining Cicero’s basis – the amount of money already having gone into the cash value component of the variable whole life policy. The basis is examined relative to the total surrender value. Anything beyond his basis may be taxable. Knowing how much in taxes would be due can aid in the decision to maintain or abandon the policy.

In addition to the amount of the possible taxable gain from surrendering the variable whole policy, we also considered Cicero’s:

-

-

- Current Marginal Tax Bracket

- Future Marginal Tax Bracket

- Total of Premium Payments through the end of the year

-

Because Cicero was not expecting a shift in his tax bracket in the short-term, it made the most sense to abandon his variable whole life policy immediately. However, this may not be the case for all individuals currently holding a variable whole life (or similar universal indexed life) insurance policy. Consider that if you are in a high-enough tax bracket, and you are looking at a large amount of taxable income from the surrender value, and you anticipate being in a significantly lower tax bracket next year, then you may consider maintaining the policy – at least until your tax bracket drops. Said another way, it may make sense to pay the insurance company a little bit of money (for now) to avoid paying Uncle Sam a lot of money (right now).

When would a client like Cicero expect to be in a situation where the tax bracket drops significantly the following year? Cicero could see a significant drop in his taxable income at the onset of his retirement, or in a year following a large taxable gain – such as the sale of investment property.

If you’re unsure if it makes sense to keep paying into your whole life, variable life, or indexed universal life insurance policy, work with a fee-only Certified Financial Planner® (CFP®) to analyze your particular policy’s surrender values, as well as your tax bracket. Without the conflict of interest stemming from the desire to earn a commission from the sales of annuities, insurance policies or other financial products, a fee-only financial planner with a Charted Life Underwriter® (CLU®) designation certifying insurance expertise can work for you as your fiduciary, helping you determine your insurance and investment needs.

Learn more about our Risk Management services, or schedule a time with an advisor.