With the election just days away and COVID-19 cases still surging globally, you may feel the unrest that goes along with not knowing the future nor being able to control it. They are calling 2020 The Year of Anxiety...

The stage is set…it is Trump/Pence vs Biden/Harris. And just in case 2020 has not been eventful enough, let’s add Kanye West to the mix. So much has happened politically and economically in 2020, that it only makes sense...

The title of today’s blog is in thanks to the many great sayings of Yogi Berra. Major League Baseball threw out its first pitch four months late, after a long delay of finding a roadmap to return safely with...

I am a first-time parent to a now 9-month-old daughter. It has been an incredible experience, and for the first time, I understand what parents meant when they said, “trust me when you have kids, you will understand.” I...

You may think that if you want to increase your financial well-being, the time spent on financial data, like Morning Star ratings and “expert” advice from major financial news outlets, is more effective than the practice of mindfully utilizing...

Wellness and the B-Word: Where to begin your financial wellness journey. Wellness seems to be an all-encompassing buzz word (buzz is not the B-word I’ll be referencing later). We often think about our body, mind, and spirit and how...

Show Me The Money: Two Rules For Your Retirement Nest Egg There are two rules that we talk about with every prospect and client when investing and starting a financial plan. First rule, don’t lose the money. Second rule,...

Free Advice is Worth Every Penny. A weathered sign hangs in our local mechanic’s garage: We offer three kinds of service – GOOD, CHEAP, FAST. You can pick any two: GOOD service CHEAP won’t be FAST GOOD service FAST...

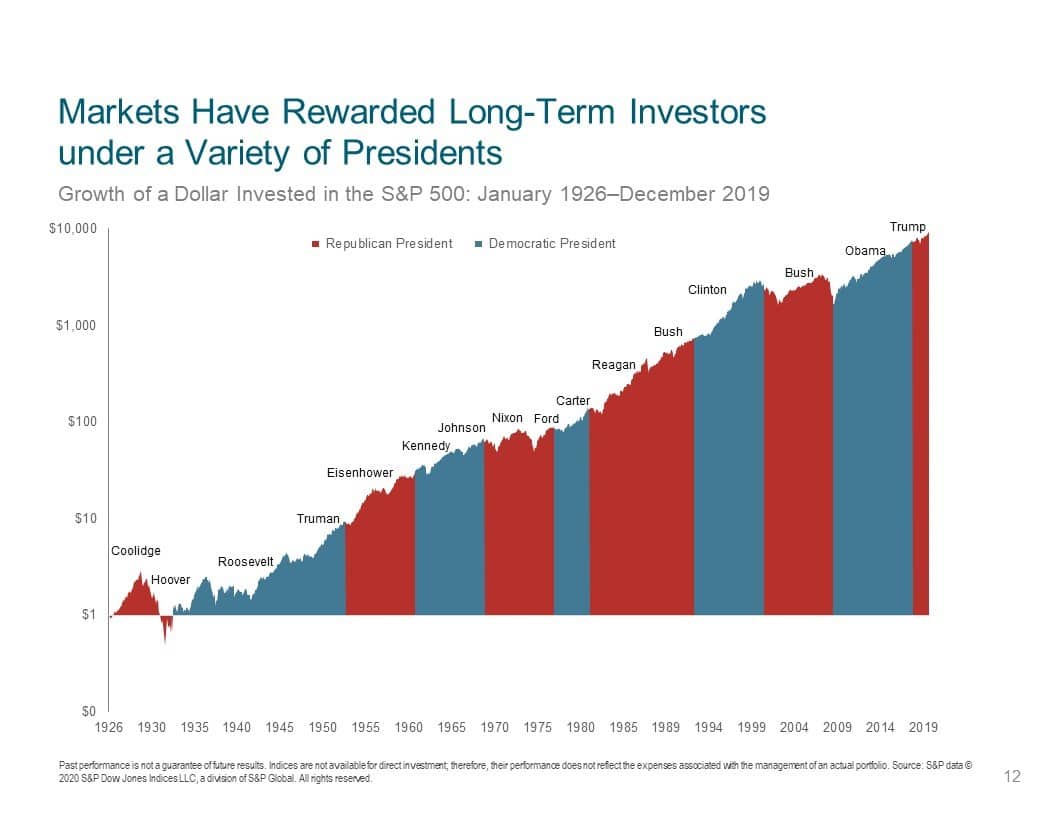

Investors have a fascination with predictions. Look at the financial media. Turn on any television show, listen to any radio program, or pick up any magazine, and you’ll see there’s always someone trying to predict future stock prices. It...

Similar to today, the Roaring 1920s saw rapid technological change with cars and electricity. This created a farm surplus as fewer horses consumed less feed. Prices fell, and farmers complained of foreign competition. Herbert Hoover promised higher tariffs in...