Work with me on this analogy. There are many pieces to a puzzle. Imagine that the puzzle you are putting together is your financial well-being. When you are putting the first few puzzle pieces in place, it is challenging...

Currently, there are very few places to grow one’s money better than investing in the stock market. And many people who have money to invest are looking for THE top stock pick to get rich, quick! This could be...

We have talked a lot about financial wellbeing in our past blogs and how not to let our emotions derail our financial plan, yet FOMO (fear of missing out) is trending now and deserves our attention. Did someone ever...

Proposition 19 recently passed in California, the results of which could mean property tax breaks for those over 55 in the state and potential tax increases for those inheriting homes from their parents or grandparents. For those homeowners thinking...

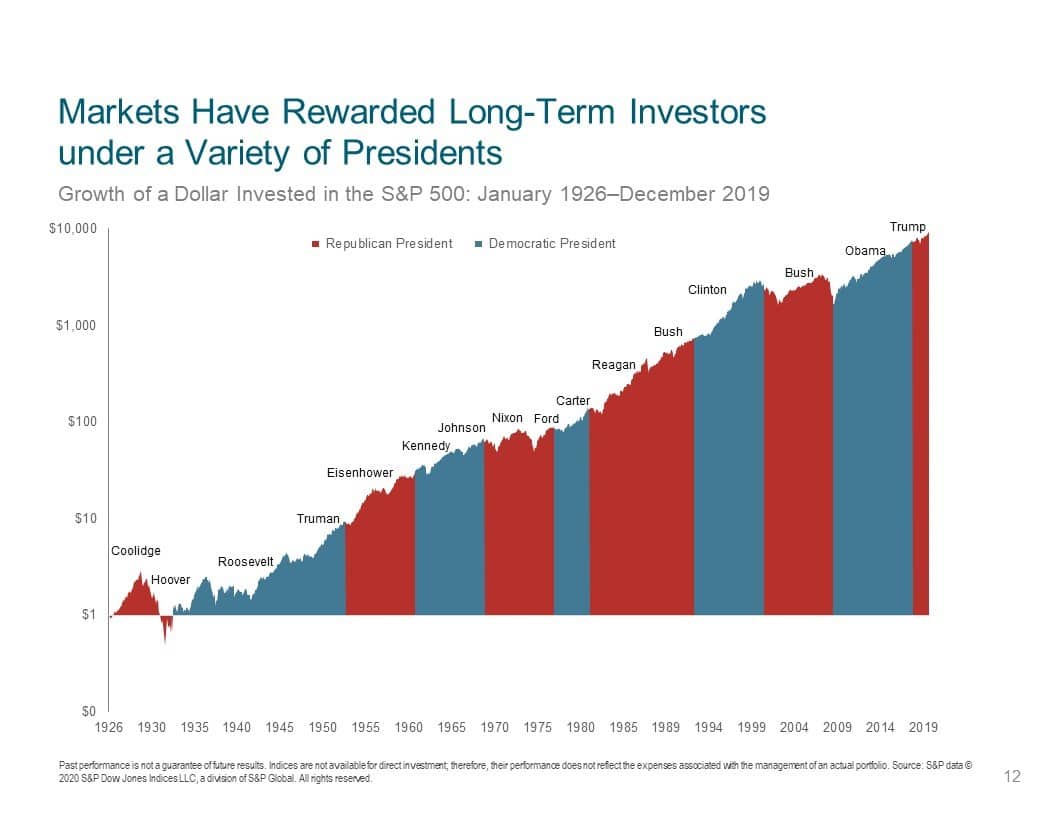

With the election just days away and COVID-19 cases still surging globally, you may feel the unrest that goes along with not knowing the future nor being able to control it. They are calling 2020 The Year of Anxiety...

The stage is set…it is Trump/Pence vs Biden/Harris. And just in case 2020 has not been eventful enough, let’s add Kanye West to the mix. So much has happened politically and economically in 2020, that it only makes sense...

The title of today’s blog is in thanks to the many great sayings of Yogi Berra. Major League Baseball threw out its first pitch four months late, after a long delay of finding a roadmap to return safely with...

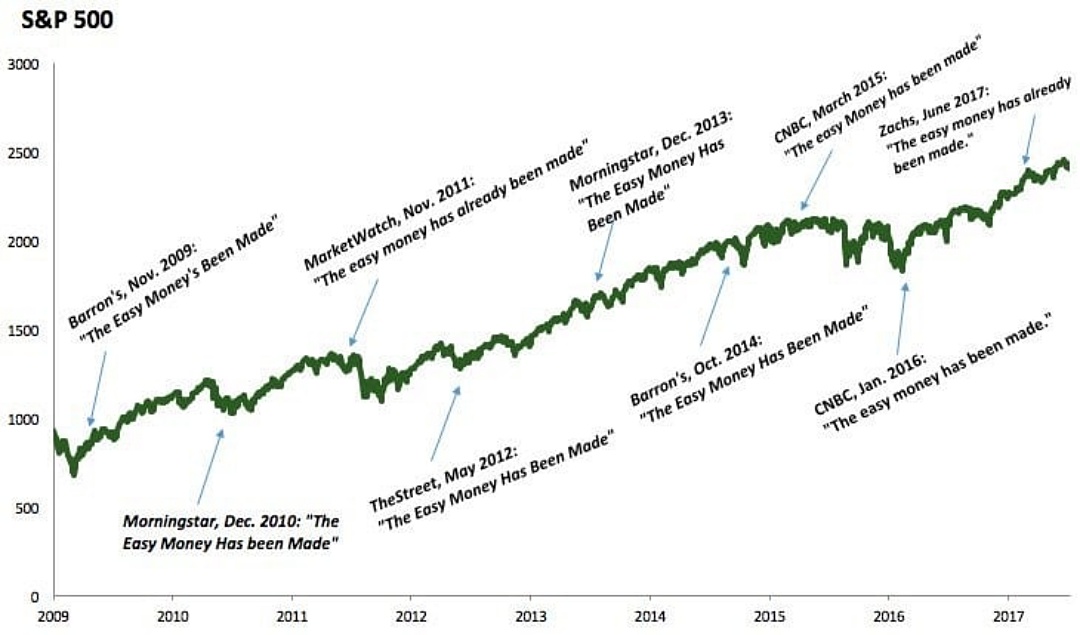

You may think that if you want to increase your financial well-being, the time spent on financial data, like Morning Star ratings and “expert” advice from major financial news outlets, is more effective than the practice of mindfully utilizing...

“The easy money has been made.” If you follow CNBC, Barron’s, or other major financial news outlets, you may have heard this term often. This phrase is used as a way to claim that positive stock market returns in...

Wellness and the B-Word: Where to begin your financial wellness journey. Wellness seems to be an all-encompassing buzz word (buzz is not the B-word I’ll be referencing later). We often think about our body, mind, and spirit and how...