Retirement planning can start in any decade of your life. In Chapter 2 of the book, Your Insiders’ Guide To Retirement, we say you must have a plan. Setting a goal is not the main thing. It is deciding how you will go about...

Creating a financial plan not only gives you a road map to your retirement goals, but it also allows you to better understand the emotional elements of the stock market. Why do very smart people make bad decisions about their money? The answer...

Experts say that healthcare alone could cost the average couple hundreds of thousands of dollars during their retirement. That high amount doesn’t even include other bills such as groceries, mortgage payments, and everyday living expenses. According to Psychology Today, the average life expectancy for...

Retirement is changing. There is a shift taking place on how we retire and who can help us get there. Gone are the days of working somewhere for 40 straight years and leaving with a pension to live on. Life is happening now, and...

Individual Retirement Account, investing, money, retirement, Trust

Financial Planning, Investment Strategies, Retirement Planning

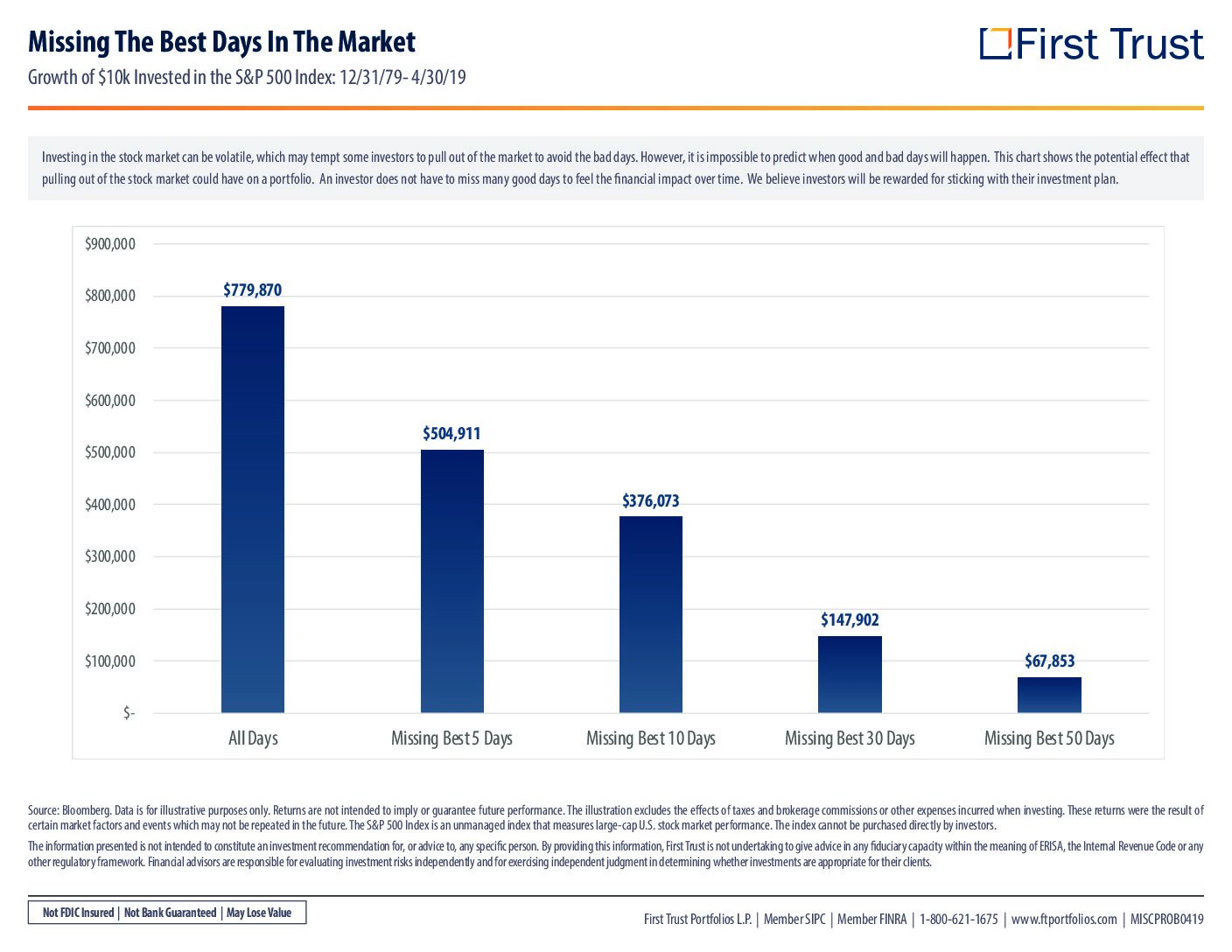

Staying the Course Investors tend to see short-term volatility as the enemy. Volatility may lead many investors to move money out of the market and “sit on the sidelines” until things “calm down.” Although this approach may appear to solve one problem, it creates...

fee-only financial planner, financial planning, investing, investment management, market, market timing, risk, safe money, stocks

The last two months have brought continued market volatility to both stocks and bonds. It can be hard to stomach at times, yet it’s also expected. The long-term investor knows that markets on average, go up 7 out of 10 years, historically. Your financial...

fee-only advisor, financial planning, great life, Individual Retirement Account, interest, market, retirement, stocks, volatility