Show Me The Money: Two Rules For Your Retirement Nest Egg There are two rules that we talk about with every prospect and client when investing and starting a financial plan. First rule, don’t lose the money. Second rule,...

Although the CARES Act’s $2 trillion allocation to the economy has been compared to President Obama’s 2009 American Recovery and Reinvestment Act, the more recent measure should be thought of as a relief effort, rather than economic stimulus. CARES is...

Are you dreaming of retirement, or currently in retirement and dreaming of a new chapter in life? Once a year everyone should take the time to review and update their financial plan. In addition to your financial needs, it’s...

Investors have a fascination with predictions. Look at the financial media. Turn on any television show, listen to any radio program, or pick up any magazine, and you’ll see there’s always someone trying to predict future stock prices. It...

Similar to today, the Roaring 1920s saw rapid technological change with cars and electricity. This created a farm surplus as fewer horses consumed less feed. Prices fell, and farmers complained of foreign competition. Herbert Hoover promised higher tariffs in...

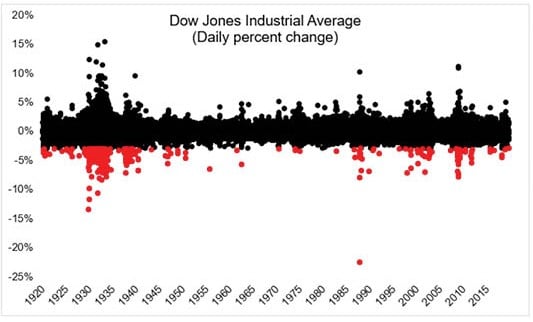

This week marked the 307th time that the Dow Jones index fell 3% or more in a single day when reviewing historical market data. The chart above displays the Dow Jones Industrial Average going back to 1920, and the...

Creating a financial plan not only gives you a road map to your retirement goals, but it also allows you to better understand the emotional elements of the stock market. Why do very smart people make bad decisions about...

Retirement is changing. There is a shift taking place on how we retire and who can help us get there. Gone are the days of working somewhere for 40 straight years and leaving with a pension to live on. ...

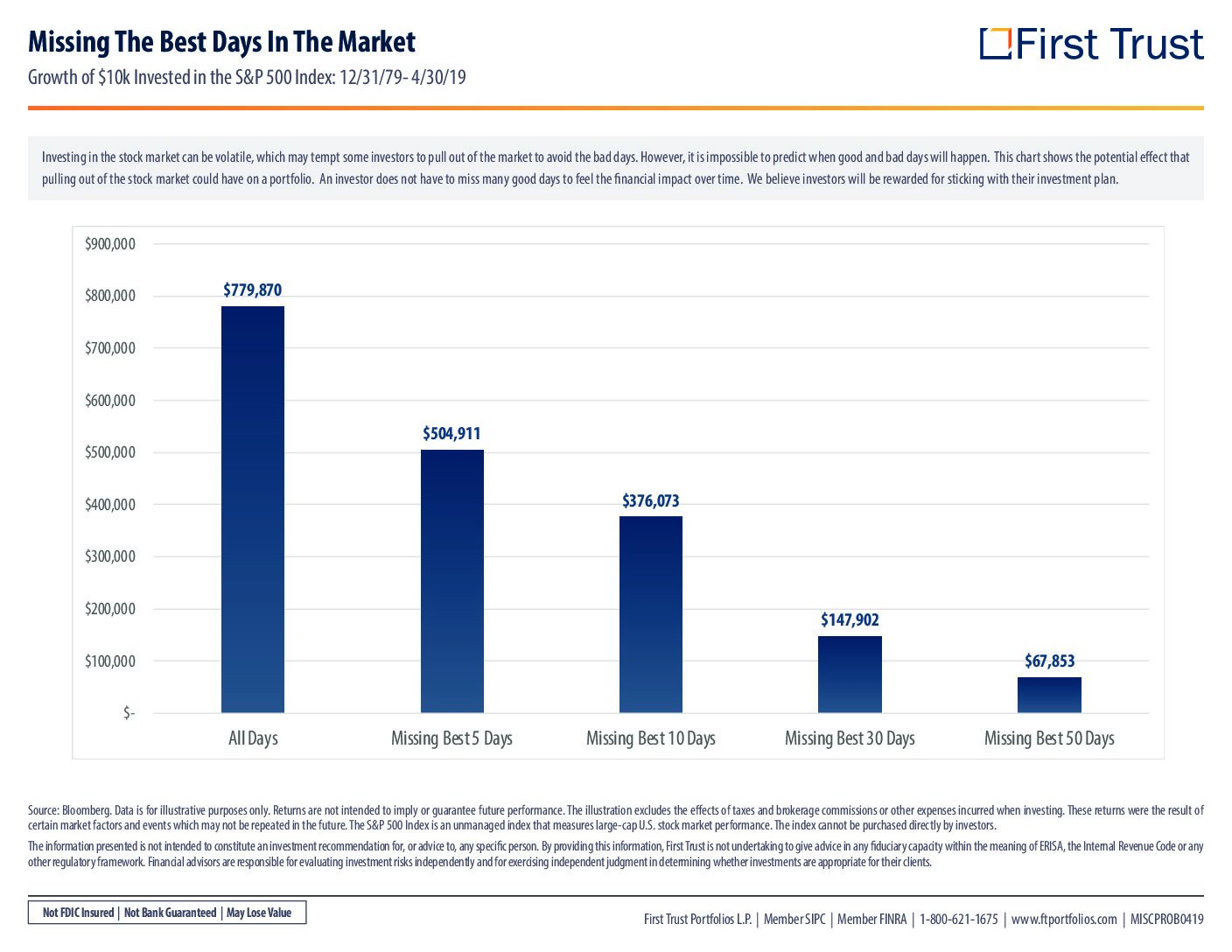

Staying the Course Investors tend to see short-term volatility as the enemy. Volatility may lead many investors to move money out of the market and “sit on the sidelines” until things “calm down.” Although this approach may appear to...

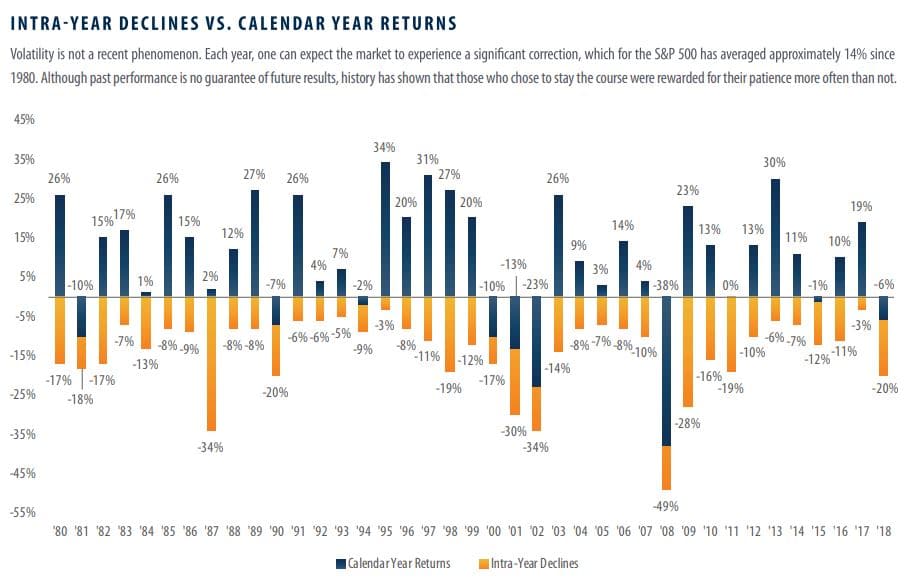

The last two months have brought continued market volatility to both stocks and bonds. It can be hard to stomach at times, yet it’s also expected. The long-term investor knows that markets on average, go up 7 out of...