Updated for 2025 As Benjamin Franklin famously said: “In this world, nothing can be said to be certain, except death and taxes.” As the IRS tax filing deadline approaches, many of us become keenly aware of and curious about...

This week’s blog post is inspired by Mark, who asks, "How much stock should I hold in my portfolio to get an investment return of 30% a year?" The answer isn't what you think it may be, because investment...

Health Savings Accounts (HSAs) are tax-advantaged medical savings plans, which can act like both a personal checking and investment account for medical expenses now or in the future. The changes for 2023 increased HSA contribution limits by $200 for...

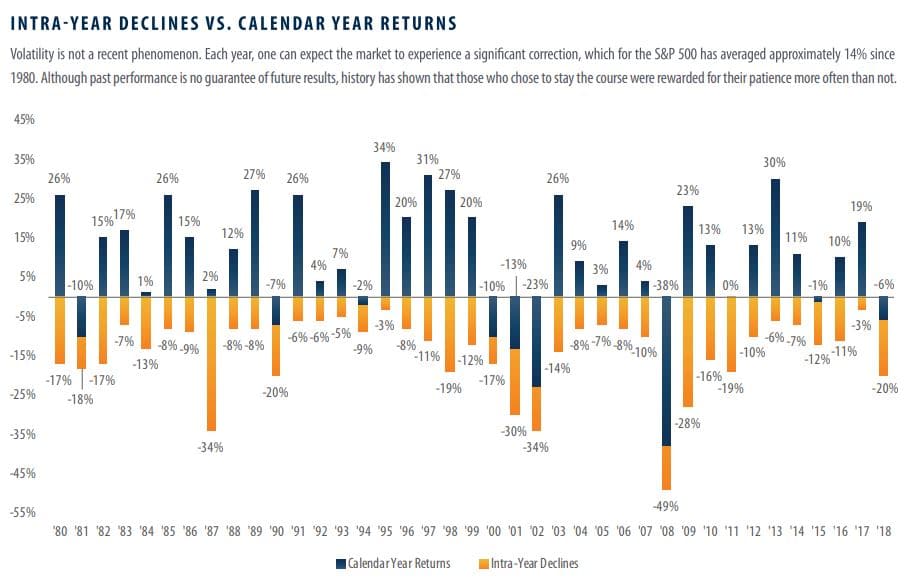

According to a survey by the Society of Actuaries, one of retirees’ biggest fears is investment losses. According to their 2021 study, 66% of pre-retirees are concerned the value of their savings and investments might not keep up with...

Given current market valuations and the pending interest rate movement, many investors are drawn to short-term investments. Fortunately for those looking to invest for the short-term, there are multiple options available. What is a Short-Term Investment? Short-term investments are...

Is the Bull market over? Are rising interest rates going to hurt bonds? Will inflation continue to rise? Why is the market so volatile? Many people are worrying. Maybe you are one of them and ask the same questions....

Currently, there are very few places to grow one’s money better than investing in the stock market. And many people who have money to invest are looking for THE top stock pick to get rich, quick! This could be...

We have talked a lot about financial wellbeing in our past blogs and how not to let our emotions derail our financial plan, yet FOMO (fear of missing out) is trending now and deserves our attention. Did someone ever...

Retirement is changing. There is a shift taking place on how we retire and who can help us get there. Gone are the days of working somewhere for 40 straight years and leaving with a pension to live on. ...

Staying the Course Investors tend to see short-term volatility as the enemy. Volatility may lead many investors to move money out of the market and “sit on the sidelines” until things “calm down.” Although this approach may appear to...