The last two months have brought continued market volatility to both stocks and bonds. It can be hard to stomach at times, yet it’s also expected. The long-term investor knows that markets on average, go up 7 out of 10 years, historically. Your financial...

Over the weekend, a relative asked, “Are we in a bear market?” I answered his question with, “What do you think a bear market is?” He rattled off a few comments about the economy, and the market being down the last couple of weeks. ...

Job numbers were released earlier this month, and it was another month, 92 consecutive months to be exact, of positive job creation in the U.S. economy…hip, hip, hooray! The good news is that unemployment is down to a near-record low of 3.8%. The not...

Did that headline get your attention? There are hundreds of distractions around us every minute of the day. It used to be just billboards along the highway, a few advertisements between your favorite radio songs, or those dreaded commercials during your prime time TV...

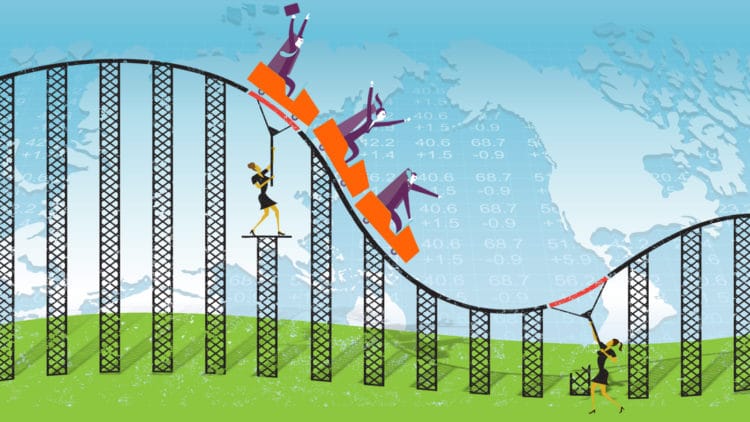

You’ve seen the headlines, you’ve heard the talking heads, you likely have negative feelings when you see the term blasted across the front page of the business periodicals. Markets have been swinging wildly in 2018. Things started off great in January with the Dow...

Many people are ready to make the transition to retirement. They envision living a less stressful, carefree lifestyle. Where they can be adventurers, live next to the ocean, hear the waves crash. Enjoy the warm sunshine, swim in the ocean and gaze at the...

alternative investments, budget, employer benefits, Estate Planning, fee-only financial planner, financial planning, great life, Individual Retirement Account, investing, investment management, life insurance, real estate, retirement, Vacation